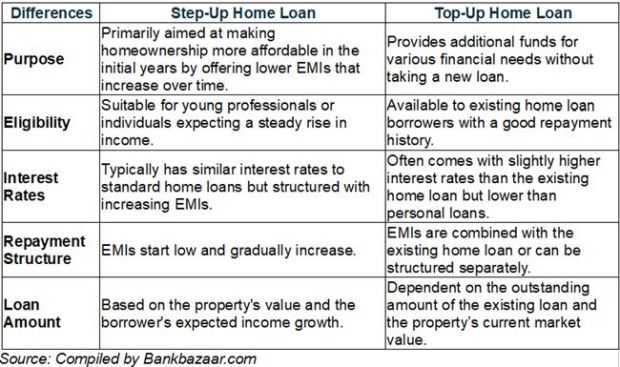

The home loan market is rapidly evolving in India, presenting a range of products to cater to the diverse requirements of potential homeowners. Step-up home loans and top-up home loans are among the favoured options available. It is, however, imperative to comprehend the differences between the two in order to make a well-informed decision.

Step-up and top-up home loans serve different financial purposes. A step-up home loan is suitable for young professionals who have lower initial incomes but anticipate significant career advancement. Conversely, a top-up home loan is beneficial for individuals who require additional funds for personal or professional expenses, without the hassle of applying for a new loan. It is important to be aware of these distinctions.

Also Read: 5 reasons to work towards building a strong credit score

Step-up home loans

A step-up home loan is designed to help borrowers who expect their income to increase over time. This type of loan offers a lower EMI (equated monthly instalment) in the initial years, which gradually increases over the loan tenure. The idea is to match the repayment capacity with the borrower’s anticipated rise in income.

Example: Imagine a young professional, aged 25 years, who has just started his career with a salary of Rs 50,000 per month. He plans to buy a house worth Rs 50 lakh. A step-up home loan allows him to start with lower EMIs, say Rs 25,000 per month for the first five years. As his career progresses and his salary increases, the EMIs will also rise, reaching Rs 40,000 per month in the later years of the loan tenure.

This is beneficial for young professionals who have lower incomes at the start of their careers but expect significant salary growth over time. It provides the flexibility to manage finances better in the initial years while ensuring the loan is repaid in full over the tenure.

Top-up home loans

A top-up home loan is an additional loan amount that can be borrowed on an existing home loan. It is available to those who already have a home loan and have a good repayment track record. The additional amount can be used for various purposes such as home renovation, furnishing, education, medical expenses or any other personal financial need.

Let’s take an example where Shweta, who has been repaying her home loan for five years, needs funds for her daughter’s higher education. Instead of applying for a new loan, she opts for a top-up loan on her existing home loan. If Shweta’s original loan amount was `40 lakh, and she has repaid `10 lakh so far, she can avail a top-up loan based on the repaid amount and the value of the property. Shweta can obtain the necessary funds without the need for additional loan documentation if the bank permits a top-up of Rs 10 lakh.

Adhil Shetty, CEO, Bankbazaar.com, explains, “Top-up loans generally come with competitive interest rates, often lower than personal loan rates, making them an attractive option for borrowers who need additional funds. It is also easier to get this loan approved and disbursed mostly for situations where you immediately need funds. However, it is advisable to compare the interest rates and terms before you apply.”

Borrowers must thoroughly assess their financial requirements when faced with the choice between the two options. Comprehending these loan offerings can significantly influence their financial well-being and the overall process of purchasing a home. Hence, it is crucial to make this decision only after carefully evaluating all available alternatives.